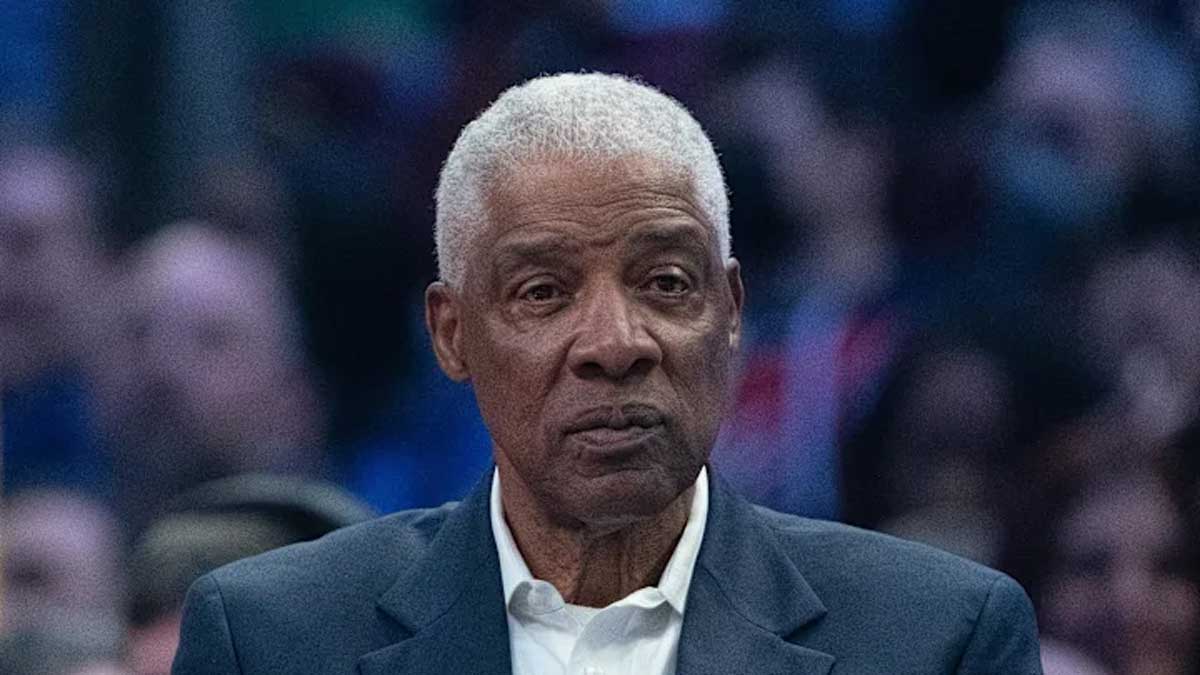

Julius Erving Net Worth: How Dr. J Built His $50 Million Fortune Beyond Basketball

Most fans remember Julius Erving for his gravity-defying dunks and championship runs with the Philadelphia 76ers. But the real story of “Dr. J” isn’t just about basketball greatness—it’s about how he turned athletic fame into a $50 million business empire that keeps growing today.

Erving didn’t follow the typical retired athlete playbook. While many former stars struggle with money after their playing days end, he was already thinking like an entrepreneur during his career. That foresight paid off big time.

The numbers tell an impressive story. From earning modest ABA salaries in the 1970s to building multiple successful companies, Erving’s wealth journey spans five decades of smart decisions and calculated risks.

Julius Erving Net Worth Overview

Current estimates put Julius Erving’s net worth at around $50 million, though some sources suggest figures ranging from $16 million to $50 million. The variation comes from different valuations of his private business holdings, which make up the bulk of his wealth today.

What sets Erving apart from many athletes of his era is where his money actually comes from. His playing career provided the foundation, but business ventures built the mansion. We’re talking about a guy who earned maybe $10 million total during his entire basketball career, yet managed to multiply that several times over through investments.

The wealth breakdown is fascinating. Basketball earnings account for less than 20% of his total net worth. The rest comes from businesses he started, companies he invested in, and real estate deals that appreciated over decades.

Compared to other NBA legends from the 1970s and 1980s, Erving ranks among the most financially successful. That’s particularly impressive when you consider he played before the massive TV contracts that made later generations of players incredibly wealthy.

Basketball Career Earnings Foundation

Erving’s money story starts in 1971 with the Virginia Squires of the American Basketball Association. His first professional contract was nothing special—typical for an undrafted player trying to make it in a league that was struggling to compete with the NBA.

The ABA years were lean financially but rich in brand building. That eight-year deal worth $350,000 annually with the Nets was decent money for the time, but more importantly, it’s when “Dr. J” became a household name. Every spectacular dunk was building equity in a brand he’d later monetize brilliantly.

Everything changed in 1976 when the ABA merged with the NBA and Erving landed with Philadelphia. His $3 million contract made headlines—suddenly he was among the highest-paid players in professional basketball. By 1985, his final season, he was pulling down $1.485 million per year.

Those salary figures might look modest now, but they were serious money in the 1980s. More importantly, they gave Erving the capital to start investing while he was still playing. That timing proved crucial for his long-term wealth building.

His on-court success created something more valuable than any single paycheck: credibility. Three championships and four MVP awards opened doors in boardrooms across America. Business leaders wanted to meet Dr. J, and Erving was smart enough to turn those meetings into opportunities.

The Business Empire Behind Dr. J’s Wealth

The Erving Group, Inc. became Erving’s business headquarters when he launched it in 1990. This wasn’t just some vanity consulting firm—it was a serious operation that leveraged his reputation to provide strategic advice across multiple industries. The company helped establish Erving as more than just a former athlete trying to stay relevant.

Dr. J Enterprises tells an even bigger story. This umbrella company handles everything from merchandise licensing to media appearances and charitable work. The reported $2.5 billion in revenue and value it’s generated for partners over the years shows the lasting power of the Dr. J brand.

But the real money came from Liberty Coca-Cola Beverages. Erving’s ownership stake in this massive bottling operation covered territory from Philadelphia to New York City. This wasn’t a small investment—it was a major business employing hundreds of people and generating millions in annual revenue.

Real estate became another cornerstone of his wealth strategy. Erving bought properties in markets he understood, focusing on locations with strong growth potential. These weren’t flashy purchases but solid investments that appreciated steadily over time while providing rental income.

His recent move into cryptocurrency with MobileCoin shows he’s still thinking ahead. The $66 million Series B funding round he participated in during 2021 proves that at 71 years old, Erving is still willing to bet on emerging technologies.

Smart Investment Decisions That Paid Off

The Electronic Arts story has become legendary in sports business circles, and for good reason. In 1983, EA wanted to create a video game featuring Erving and Larry Bird. Both players got the same offer: $25,000 cash or 20,000 stock options at $1 per share.

Bird took the cash. Can’t blame him—$25,000 was real money, and stock options from a small software company seemed risky. Erving saw something different. He took the options, and when EA went public in 1989, those shares became worth millions.

This wasn’t just luck. Erving understood that his name and likeness had long-term value that could grow with the right company. By the mid-1990s, his EA holdings had made him more money than several years of NBA salaries combined.

The Philadelphia bottling plant investment showed similar thinking. While other athletes were buying restaurants or nightclubs, Erving invested in an essential business with steady cash flow. He owned the majority stake for twenty years, benefiting from both operational profits and the eventual sale.

His real estate approach was equally methodical. Instead of buying flashy properties, he focused on markets he knew well and properties with strong fundamentals. The strategy paid off as these investments appreciated significantly over decades.

Brand Value and Endorsement Legacy

Erving’s 1976 Converse deal changed sports marketing forever. That $20,000 annual contract was reportedly the first basketball shoe endorsement in history. Adjusted for inflation, it’s worth about $90,000 today—not bad for pioneering an entire industry.

The relationship with Converse grew over time, reaching $100,000 annually by the mid-1980s. But the real value wasn’t just the money—it was establishing the template for athlete endorsements that would eventually make players like Michael Jordan incredibly wealthy.

Speaking of Jordan, there’s an interesting connection. When MJ was entering the NBA in 1984, he wanted to stick with Converse, the brand he’d worn at North Carolina. But Converse wouldn’t pay Jordan more than they were paying established stars like Erving and Bird. That decision sent Jordan to Nike, creating one of the most valuable partnerships in sports history.

Erving’s 2016 decision to sell the lifetime rights to “Dr. J” to Authentic Brands Group was another smart move. ABG specializes in managing celebrity brands, including dead icons like Elvis and Muhammad Ali. The deal gave Erving immediate capital plus ongoing royalties, ensuring his brand continues generating income.

The arrangement with ABG shows Erving’s understanding of brand management. Rather than trying to handle licensing and merchandising himself, he partnered with experts who could maximize the value of his name and image across multiple product categories.

Modern Business Ventures and Investments

Even in his seventies, Erving keeps finding new opportunities. Black Sheep Mob, his children’s clothing line, targets the luxury streetwear market with designs that blend high-end fashion with accessible pricing. It’s a niche play that leverages his style credibility.

His involvement with Anthem Media Group makes perfect sense for someone who understands sports entertainment. As both shareholder and brand ambassador, he’s helping shape how fantasy sports content reaches audiences through FNTSY Sports Network and RotoExperts.com.

The NASCAR venture with Joe Washington was more adventurous. Their Busch Series team represented something unique—former basketball and football stars trying to make it in auto racing. While it didn’t last long, it showed Erving’s willingness to explore opportunities outside his comfort zone.

MobileCoin represents his most forward-thinking recent investment. Cryptocurrency might seem like an odd choice for a 71-year-old, but Erving has always been willing to bet on technologies he believes in. The company’s focus on privacy and security aligns with growing concerns about digital financial transactions.

These diverse investments reflect a consistent strategy: maintain multiple income streams while staying current with emerging trends. It’s the same approach that’s worked for Erving throughout his post-basketball career.

Conclusion

The story of Julius Erving’s wealth goes far beyond basketball statistics. His $50 million net worth represents decades of strategic thinking, calculated risks, and smart partnerships. While other athletes from his era struggled with post-career finances, Erving built an empire.

What makes his success particularly impressive is the era he played in. Modern NBA stars sign contracts worth hundreds of millions, but Erving had to create his wealth through business acumen rather than massive playing salaries. His approach offers lessons for any athlete looking to build lasting financial security.

The Dr. J brand continues generating value more than 30 years after his retirement. That’s the mark of someone who understood early that athletic careers are short, but smart business decisions can pay dividends for life. From stock options to real estate, from bottling plants to cryptocurrency, Erving’s financial playbook is as impressive as any move he ever made on the basketball court.